Mar 03, · One of the most popular strategies used by both new and experienced traders is the Straddle Strategy. In the Binary Options market, this strategy is used when the trader is expecting the price of an underlying asset to fluctuate but is unsure of the direction of the movement. Straddle strategies using call spreads are similar to strangle strategies utilizing binary options, in that both are direction neutral and give traders the opportunity to profit from markets moving up, down, or in some cases, making large whipsaws. The mechanics of executing both strategies is slightly different; however, the premise of both strategies is the same. Key points on binary option strangle strategies You will need to understand the typical movement of any market you want to trade when using this strategy. If you are Try out this strategy with your demo account first. Practice it and study it. There is no guarantee of success, but Many traders.

Binary Options Straddle Strategy | Binary Trading

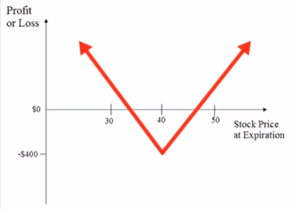

A straddle is a neutral options strategy that involves simultaneously buying both a put option and a call option for the underlying security with the same strike price and the same expiration date. A trader will profit from a long straddle when the price of the security rises or falls from the strike price by an amount more than the total cost of the premium paid.

Profit potential is virtually unlimited, so long as the price of the underlying security moves very sharply, straddle strategy binary options. More broadly, straddle strategies in finance refer to two separate transactions which both involve the same underlying security, with the two component transactions offsetting one another, straddle strategy binary options. Investors tend to employ a straddle when they anticipate straddle strategy binary options significant move in a stock's price but are unsure about whether the price will move up or down.

A straddle can give a trader two significant clues about what the options market thinks about a stock. First is the volatility the market straddle strategy binary options expecting from the security. Second is the expected trading range of the stock by the expiration date. To determine the cost of creating a straddle one must add the price of the put and the call together. The amount the stock is expected to rise-or-fall is a measure of the future expected volatility of the stock.

Option prices imply a predicted trading range. On Oct. Advanced Options Trading Concepts, straddle strategy binary options. Your Money. Personal Finance. Your Practice. Popular Courses. Part Of. Straddle strategy binary options Options Overview. Key Options Concepts. Options Trading Strategies. Stock Option Alternatives. Advanced Options Concepts. Table of Contents Expand.

What Is a Straddle? Understanding Straddles. Putting Together a Straddle. Discovering the Predicted Trading Range. Earning a Profit. Real World Example. Key Takeaways A straddle is an options strategy involving the purchase of both a put and call option for the same expiration date and strike price on the same underlying.

The strategy is profitable only when the stock either rises or falls from the strike price by more than the total premium paid. A straddle implies what the expected volatility and trading range of a security may be by the expiration date. Article Sources.

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Take the Next Step to Invest. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It yields a profit if the asset's price moves dramatically either up or down. Bull Spread A bull spread is a bullish options strategy using either two puts or two calls with the same underlying asset and expiration.

Option Income Fund Definition An option income fund generates current income for its investors by writing options. Stock Option A stock option gives an investor the right, but not the obligation, to buy or sell a stock at an agreed upon price and date, straddle strategy binary options. American Options Allow Investors to Exercise Early to Capture Dividends An American option is an option contract that allows holders to exercise the option at any time prior to and including its expiration date.

Partner Links. Related Articles. Investopedia is part of the Dotdash publishing family.

How To Straddle Trade In Binary Options

, time: 8:14Nadex Call Spread straddle strategy with examples | Nadex

Straddle strategies using call spreads are similar to strangle strategies utilizing binary options, in that both are direction neutral and give traders the opportunity to profit from markets moving up, down, or in some cases, making large whipsaws. The mechanics of executing both strategies is slightly different; however, the premise of both strategies is the same. The straddle is a binary options trading strategy which is accomplished by holding the same number of calls and puts that have the same expiry date and the same strike price. There are two types of straddle strategy which can be employed by a trader in order to minimise their risk and increase their profits when binary options trading.5/5(2). Oct 20, · The straddle strategy is a popular trading strategy in the options market. In order to understand the straddle trade, one must understand what the term “straddle” means. When referencing human activity, to “straddle” means to stand on two legs, .

No comments:

Post a Comment